Home Page – Fintech

We believe that the future is commoditized banking services in the cloud.

The transformation from legacy bespoke solutions in banking operations to lighter weight frameworks and commoditized banking and payment rails is already underway. MicroServices architecture, API driven, Headless, Cloud.

Cloud Hosted Managed Banking Solutions

We offer a range of solutions for sponsor banks, lenders, fintechs, legacy financial institutions, and embedded finance providers.

What we offer

All the tools and resources needed to scale your fintech solution

Loan Management and System of Record, combined with scalable ledger and current account, connected to a modern payment orchestration engine provides an agile and extensible platform. Focus on your customer, innovate rapidly, and scale and grow your solution with a lower overall total cost of ownership and time to market.

Composable Financial Services

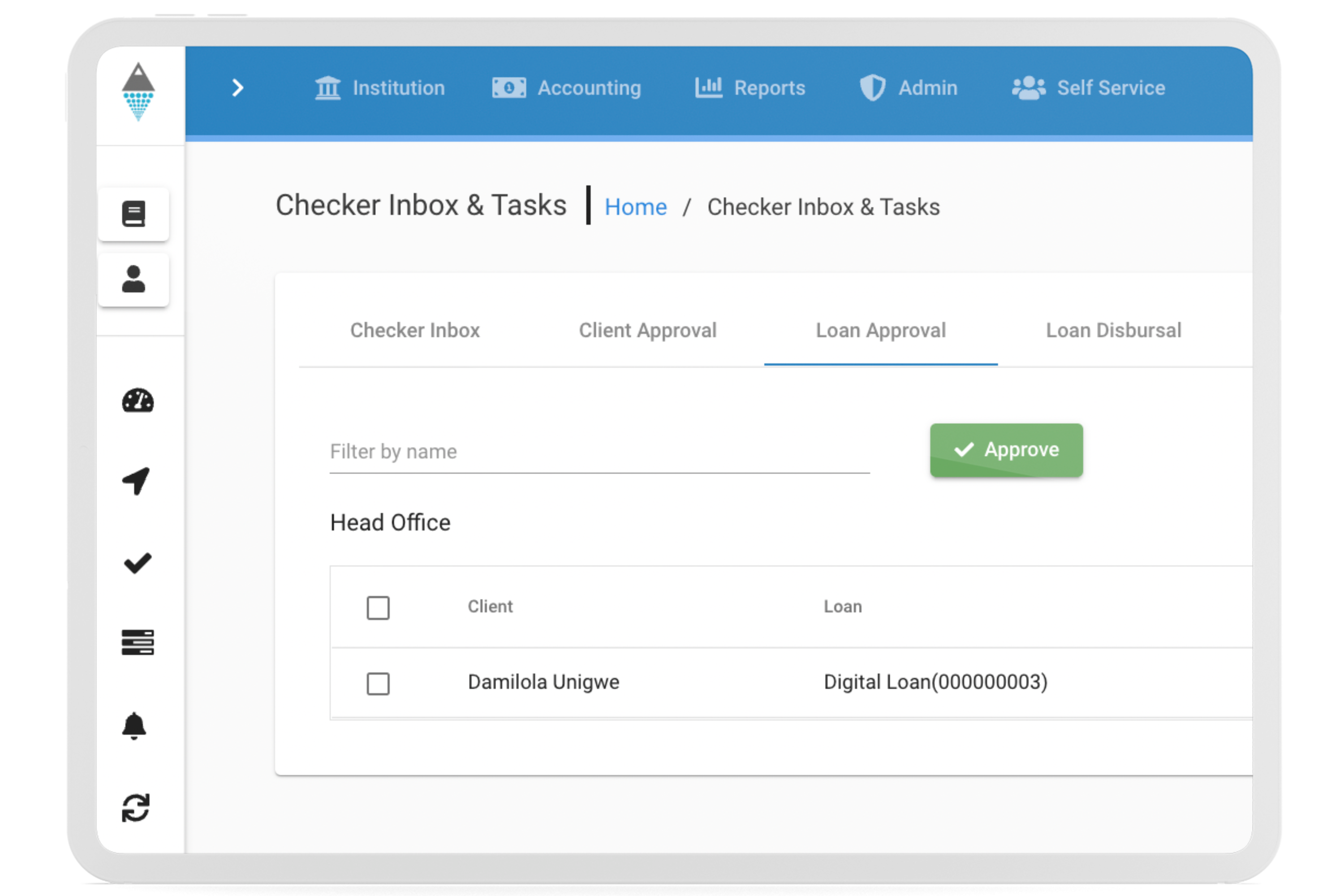

Hosted Lending Capabilities and Retail Banking Backend

With a rich set of features around product configurations we can support hundreds of different types of lending products. Our admin interface is built with the user in mind.

Developer friendly

Smart, powerful APIs

Our headless banking core is accessible via a full set of well-documented APIs meaning you can get to market with your own front end UIs and third party integrations.

Fully Extensible

Payment and Process Orchestration

Our flexible process orchestration is based on an award winning BPMN engine. We speak real-time payments and ISO 20022.

Our Solutions →

From fully hosted SAAS to professional services & support, we help you get to market quickly and get the most value out of an upstream open core.

About the Company →

We are the experts in harnessing open source to transform banking, payments, inclusive fintech, and financial services writ large.