BaaSFlow Kenu for Neobanks

BaaSFlow Kenu for Neobanks

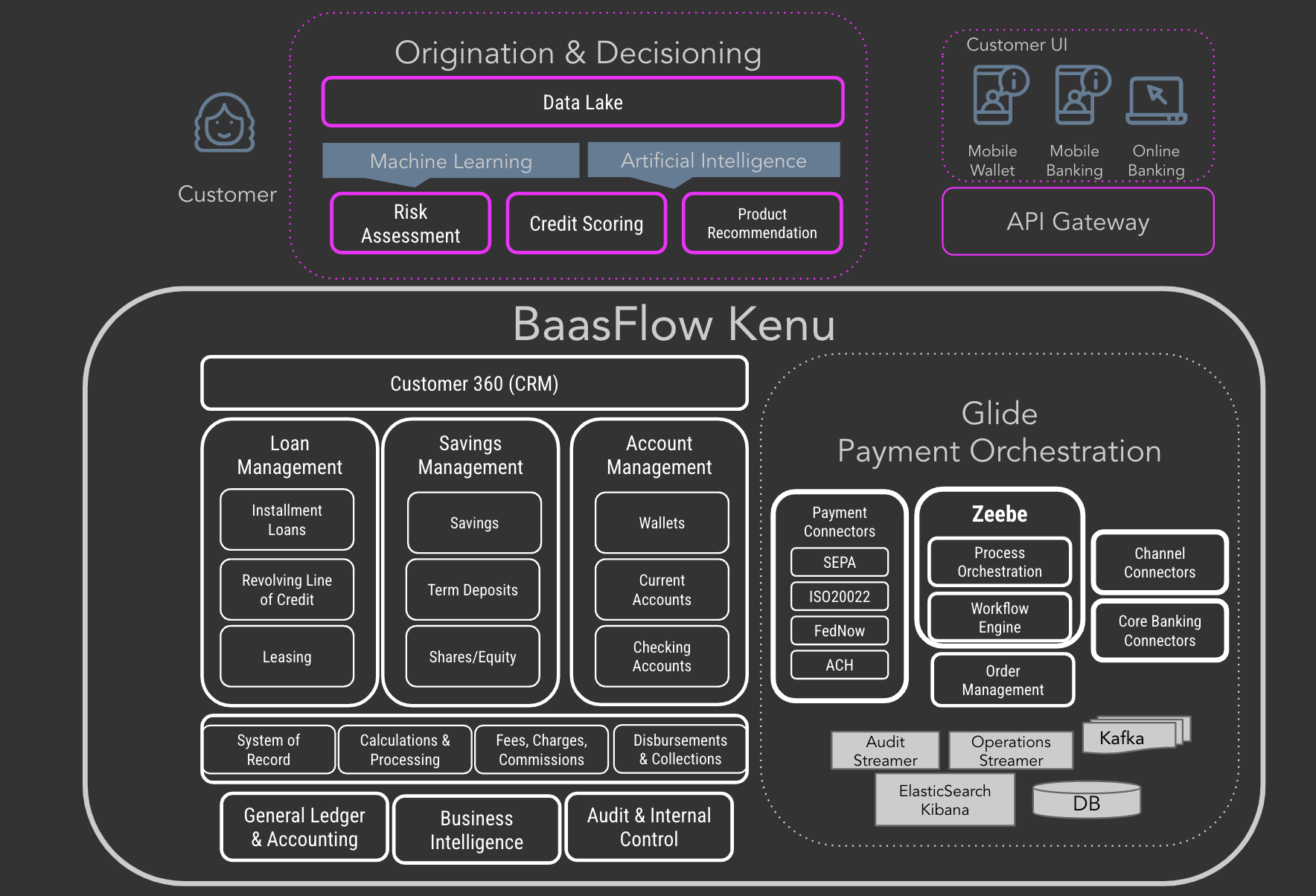

Modern, API-driven core banking platform and payment orchestration engine to unleash the power of neobanks

Fueling Innovation

Secure and scalable back-end to super-charge your customer-facing front-ends and digital experiences.

Scalable

With a modern composable architecture our solution scales securely in the cloud supporting high volume transactional accounts and digital lending use cases.

Highly Adaptable

Our centralized product configuration allows you to define and immediately launch an unlimited number of credit or savings products for individuals and businesses.

Payments Ready

Using our Glide payment orchestration engine, offer your customers any digital payment experience including ISO 20022 real-time and batch payments via SEPA, FedNow, and more.

Seamless Integration

Our event-driven architecture and API-first design enables seamless integration with your downstream systems and channels

Seamless Integration

Seamless integration into downstream systems via APIs, webhooks, and auto-generated SDKs & clients

Scalable System of Record

Massively scalable system of record to track the entire credit and deposit lifecycle supporting hundreds of millions of accounts with 1000 write operations per second and 8000 read operations per second.

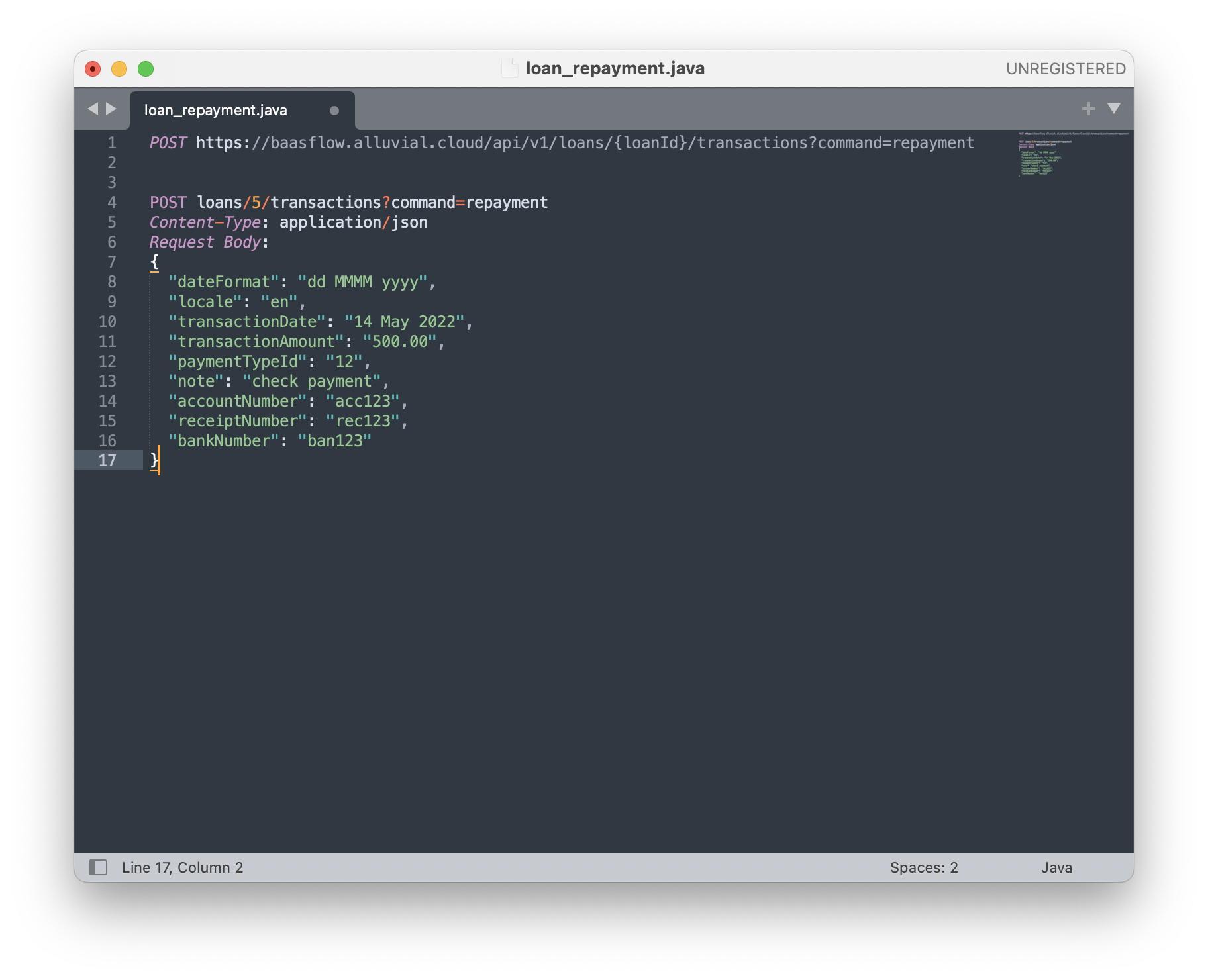

API-Driven Design

Full Core Banking System accessible via REST APIs in Swagger OpenAPI format

Batch Job Processing

Highly scalable batch job framework powered by Spring Batch enabling the parallelized close of business processing with configurable business steps and support for in-line real-time transactions during processing.

Event-Driven Architecture

Flexible reliable event framework powered by Kafka enabling you to configure and generate any real-time business event to stream downward to your other systems.

Modern Composable Architecture Powered by Fineract

Scale effortlessly with our platform in the cloud, seamlessly integrating with your front-end channels and downstream systems.

BaasFlow Kenu Core Solution

While the Fineract core provides a powerful and highly adaptable core banking system to manage your operations, we recognize you need an end to end solution to support the niche markets neobanks serve. BaaSFlow Kenu provides a number of proprietary modules and integrations, critical for digital banks.

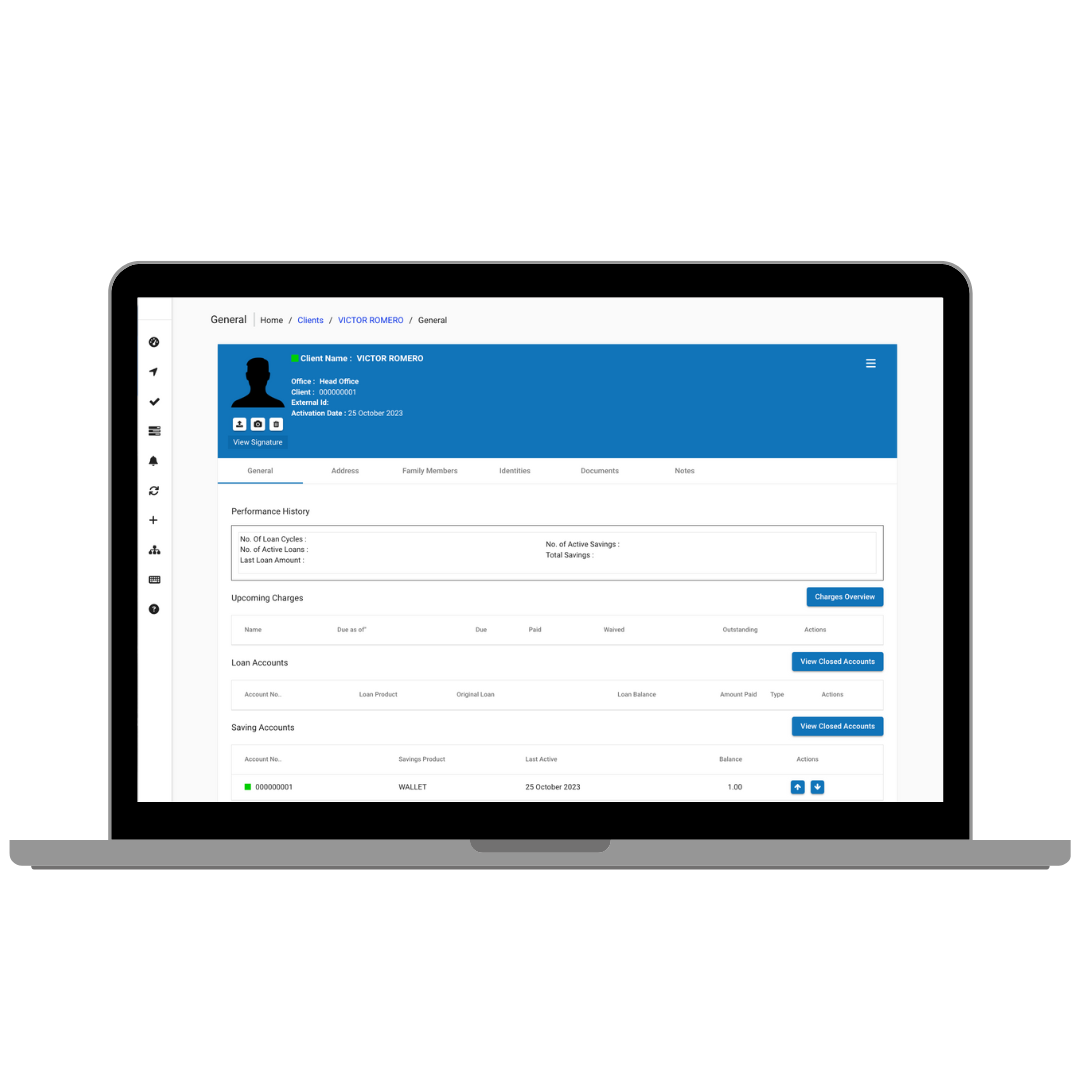

Customer 360

CRM module to provide a holistic comprehensive view of individual & corporate customers that is tightly integrated into the Fineract data model.

Scalable Wallet Account

BaaSFlow Kenu's transactional account module scales to 5000TPS to support all your high-volume wallet and current account transaction processing needs.

Digital KYC & Onboarding

Digital onboarding suite adaptable to the local requirements for onboarding customers and securely verifying their KYC and KYB credentials.

ISO 20022 Payment Integration

Whether it’s real-time, batch-based or mobile, you can integrate seamlessly with payment channels for all your payment flows.

Secure Back-end for Front-End

Secure back-end for front-end to seamlessly connect your customer apps or use our white-labeled mobile banking app.

Document Management

eSignature and document management module allows you to securely track and manage the end to end lifecycle of loans for your customers.

Output Management

Output management module generates a wide range of statements, reports, and documents to transparently keep your customers informed.

Notifications

Notifications framework enables you to communicate directly and proactively with your customers based on real-time events streamed from the system.

Case Study: BinX

Learn how BaaSFlow helped a European neobank revolutionize banking services for SMEs with a modern digital core.

Commercial OSS & Banking SaaS powered by Fineract

Open Source is in our DNA and upstream-first is our only approach. Our team is led by the experts who founded and maintain the Mifos and Fineract OSS projects. We help you unlock value from OSS by providing you scalable, secure, reliable, end-to-end solutions powered by open source.

Fineract Development Services

Consulting and development services to help design, architect, and build your solution on the upstream Mifos and Fineract codebases enabling you to get to market quickly and cost-effectively.

Core Banking and LMS as a Service

BaaSFlow Kenu - Secure, scalable fully hosted end to end solutions for core banking and loan management delivered via the cloud to power your fintech innovation and digital transformation needs.

Payment Orchestration

Glide - our modern orchestration engine enabling the seamless participation in digital payment rails from instant payments to mobile money to open banking, scalable, secure, and ISO 20022 compliant.

The BaaSFlow Difference

Building on top of commoditized core banking infrastructure in the cloud, we provide you an agile and extensible platform to focus on your customer, innovate rapidly, and scale and grow your end-to-end solution.

Scalable & Secure

Proven scalability and performance in the cloud

Payments Included

Payment Orchestration to seamlessly move money across channels.

Upstream Influence

Committed to our customers while contributing to and anchoring the community

Cost-Effective

Affordable SaaS model that aligns with your growth

End to End Solution

Robust modules beyond Fineract & extensive library of integrations.

UX Differentiation

Secure Back-end for Front-End for all your Channels and Apps

Continous Evolution

Regular stable, secure hardened production releases.

Enterprise Support

Flexibility & Agility of open source with the confidence & reliability of a vendor.