BaaSFlow Kenu LMS

BaaSFlow Kenu LMS

The world’s leading loan management platform powered by Apache Fineract. Modern, Composable, API-Driven Lending at Scale.

Lending Redefined

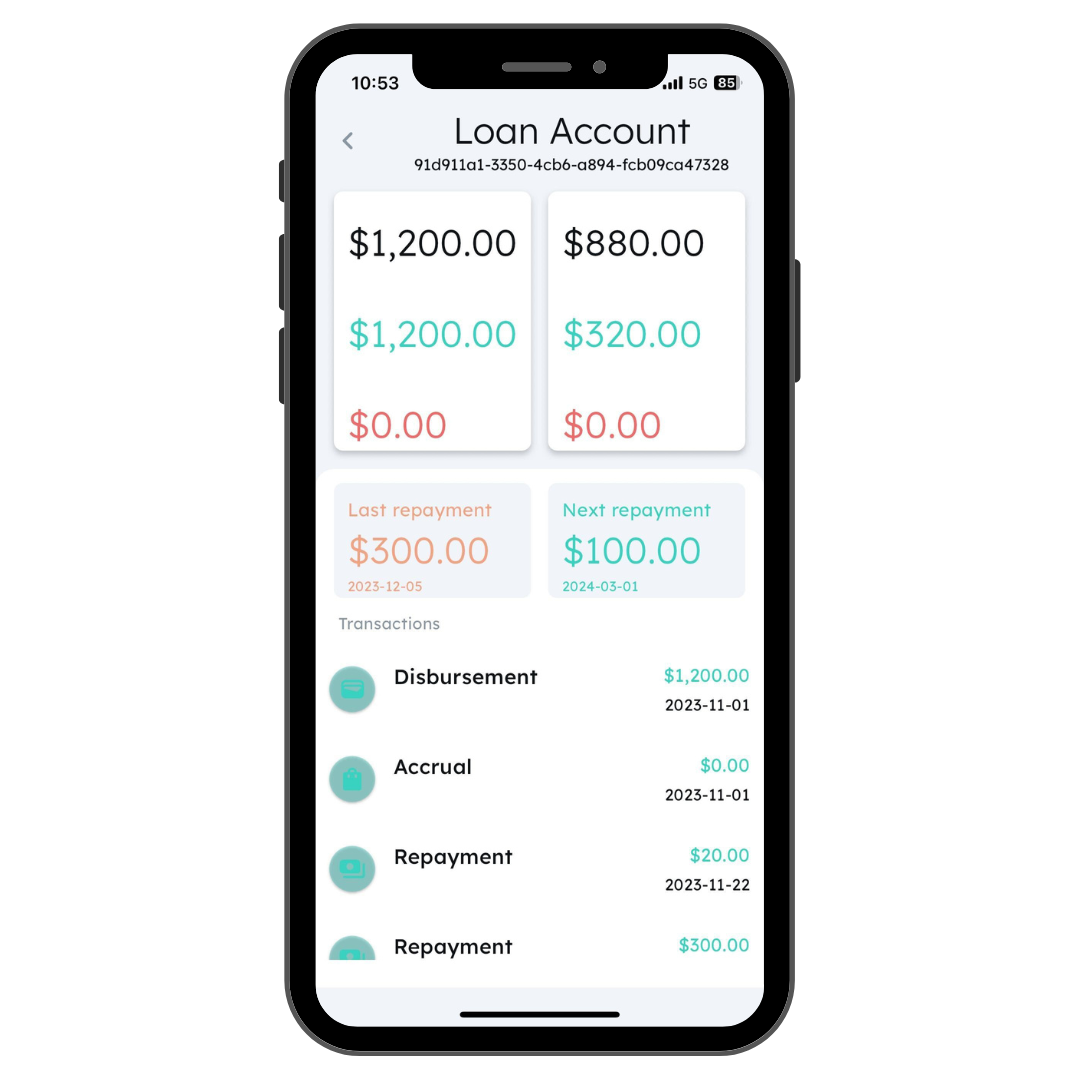

Grow and innovate with a lending platform that allows you to put the customer first and deliver next-generation credit experiences.

Scalable

With a modern composable architecture our solution scales securely in the cloud supporting up to 1000 Account Openings Per Second and 8000 View Operations per Second

Highly Adaptable

Our centralized product configuration allows you to define and immediately launch an unlimited number of credit products for individuals and businesses.

Payments Ready

Coupled with our Glide payment orchestration engine, you can disburse and collect your loans via the payment channels of your choice.

Seamless Integration

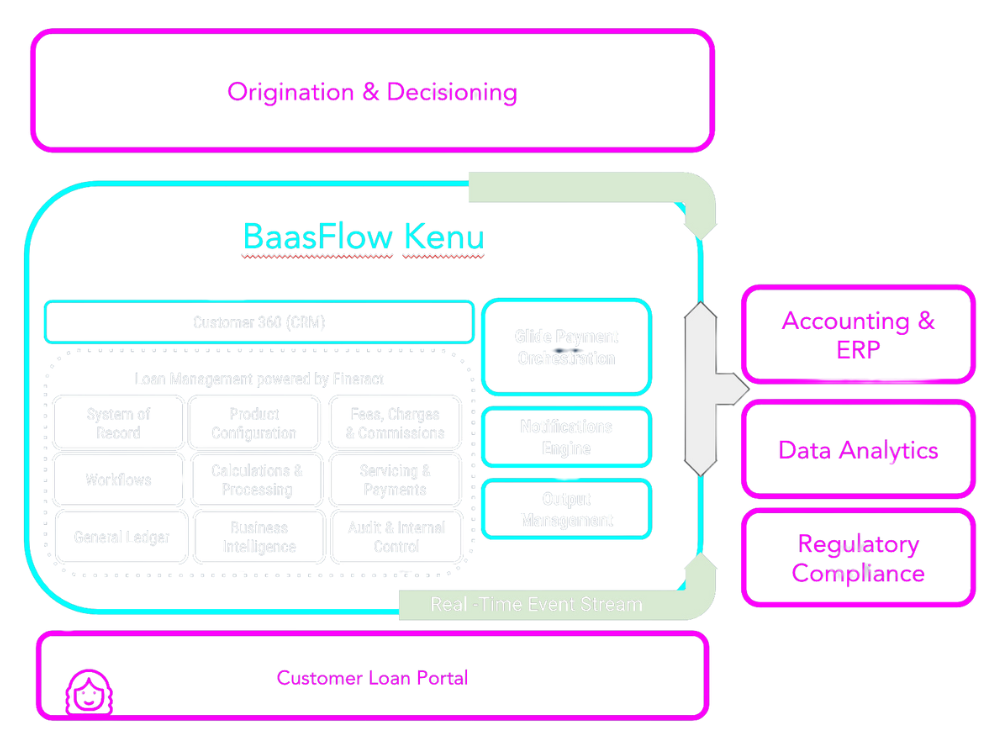

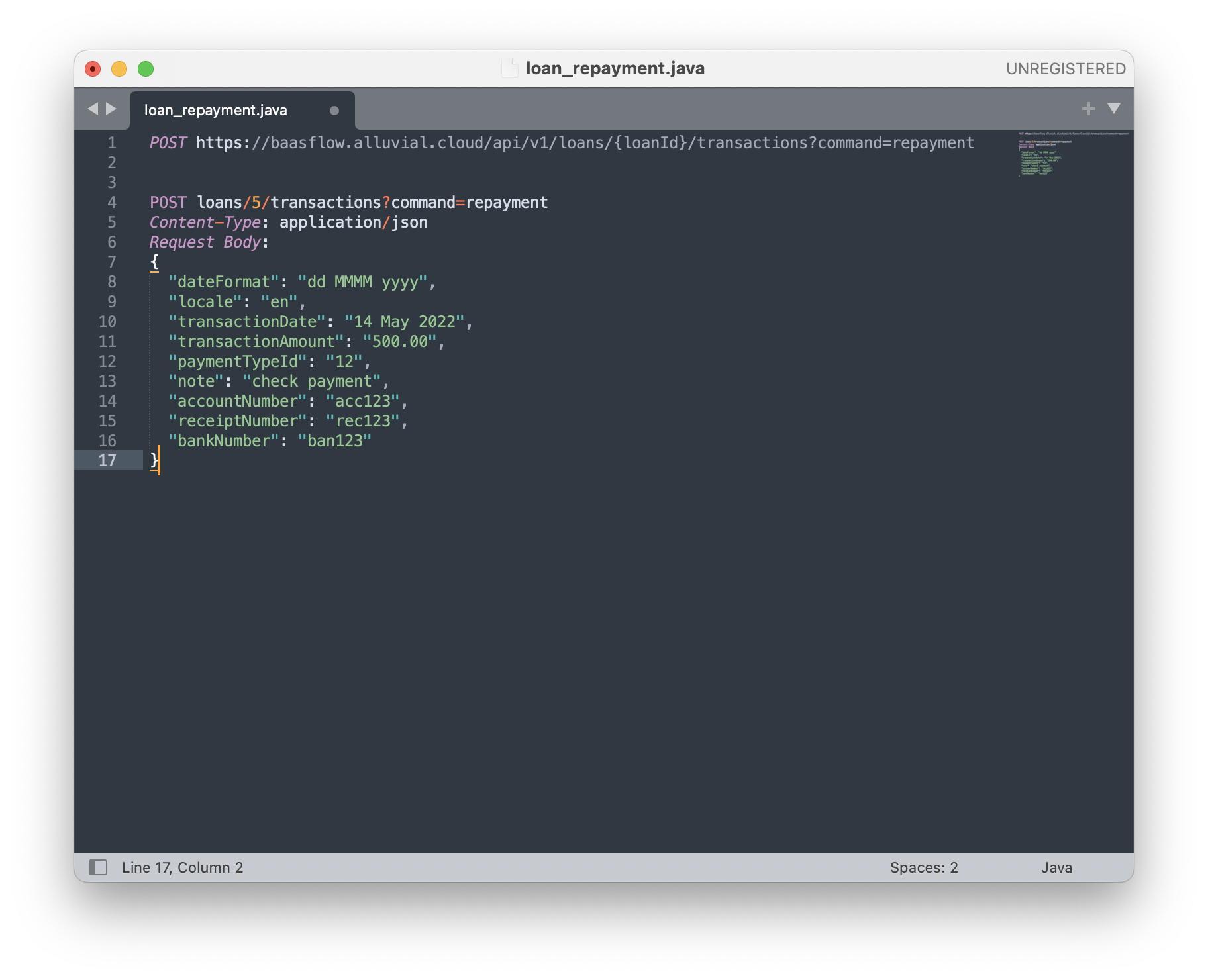

Our event-driven architecture and API-first design enables seamless integration with your downstream systems and channels

Seamless Integration

Seamless integration into downstream systems via APIs, webhooks, and auto-generated SDKs & clients

Scalable System of Record

Massively scalable and robust system of record to track the entire credit lifecycle supporting hundreds of millions of accounts with 1000 write operations per second and 8000 read operations per second.

API-Driven Design

Full Core Banking System accessible via REST APIs in Swagger OpenAPI format

Batch Job Processing

Highly scalable batch job framework powered by Spring Batch enabling the parallelized close of business processing with configurable business steps and support for in-line real-time transactions during processing.

Event-Driven Architecture

Flexible reliable event framework powered by Kafka enabling you to configure and generate any real-time business event to stream downward to your other systems.

Modern Composable Architecture

Scale effortlessly with our platform in the cloud, seamlessly integrating with your front-end channels and downstream systems.

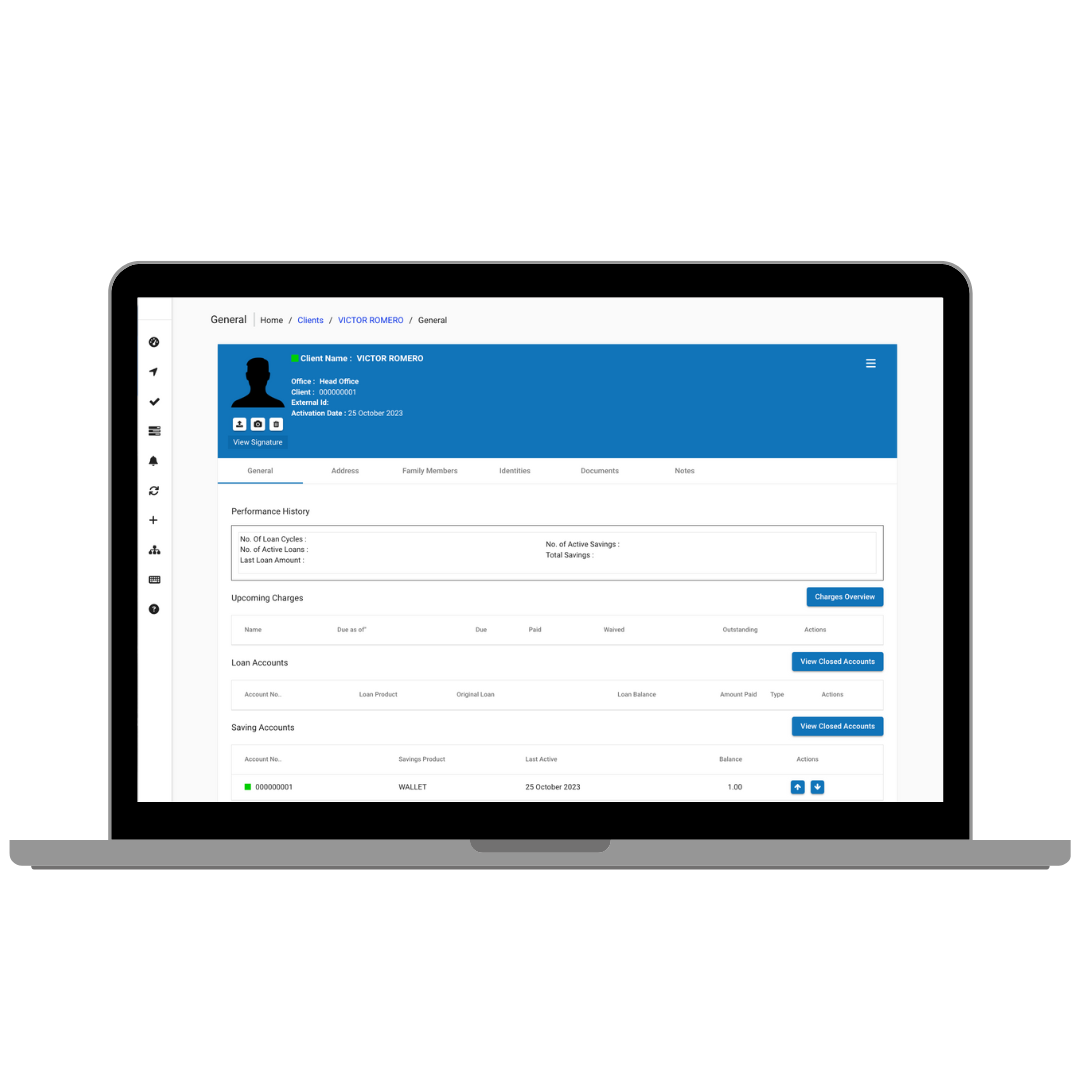

Robust Loan Management

Innovate with no limits on top of our robust lending engine with no-code configuration of a range of products for individuals & businesses.

Centralized Product Configuration Engine

Design and create any type of lending product with fully parameterized interest rates, repayment schedules, amortization, variable and fixed terms calculations, dormancy periods, delinquency buckets, collateral and more.

Configurable Payment Application Logic

Configure by transaction type the order in which payments get applied to principal, interest, fees, and penalties supporting both progressive and cumulative loan schedules

Fees & Charges

Fees & Charges - Flexibly configure flat & percentage-based fees, charges, and penalties at the loan & client level on a recurring or one-time basis along with support for VAT.

Accounting & Ledger

Robust general ledger and chart of accounts with automated posting of financial transactions and configurable advanced accounting rules.

Collections & Delinquency Management

Track delinquency & portfolio health as well as restructure & reschedule loans.

Flexible Data Model & Reporting Engine

Flexible data tables for dynamic data capture and complete business intelligence engine to design, create, and schedule any performance, operational and financial reports.

Case Study: Lending at Scale

Discover how BaaSFlow helped a global fintech scale its loan management system of record to 100 million loans per year.

Commercial OSS & Banking SaaS powered by Fineract

Open Source is in our DNA and upstream-first is our only approach. Our team is led by the experts who founded and maintain the Mifos and Fineract OSS projects. We help you unlock value from OSS by providing you scalable, secure, reliable, end-to-end solutions powered by open source.

Fineract Development Services

Consulting and development services to help design, architect, and build your solution on the upstream Mifos and Fineract codebases enabling you to get to market quickly and cost-effectively.

Core Banking and LMS as a Service

BaaSFlow Kenu - Secure, scalable fully hosted end to end solutions for core banking and loan management delivered via the cloud to power your fintech innovation and digital transformation needs.

Payment Orchestration

Glide - our modern orchestration engine enabling the seamless participation in digital payment rails from instant payments to mobile money to open banking, scalable, secure, and ISO 20022 compliant.

The BaaSFlow Difference

Building on top of commoditized core banking infrastructure in the cloud, we provide you an agile and extensible platform to focus on your customer, innovate rapidly, and scale and grow your end-to-end solution.

Scalable & Secure

Proven scalability and performance in the cloud

Payments Included

Payment Orchestration to seamlessly move money across channels.

Upstream Influence

Committed to our customers while contributing to and anchoring the community

Cost-Effective

Affordable SaaS model that aligns with your growth

End to End Solution

Robust modules beyond Fineract & extensive library of integrations.

UX Differentiation

Secure Back-end for Front-End for all your Channels and Apps

Continous Evolution

Regular stable, secure hardened production releases.

Enterprise Support

Flexibility & Agility of open source with the confidence & reliability of a vendor.